Bay Area Housing Market Update - June 2019

“Summer, summer, summertime. Time to kick back and unwind.”

- DJ Jazzy Jeff & The Fresh Prince

Summer, we’re glad you’re here.

June offers up two reasons to celebrate: Pride and National Homeownership Month. We are staunch advocates of improving equitable access to homeownership. Polls consistently show that most people in America want to own a home at some point.

A sharp decline in housing affordability is hindering millions of aspiring homeowners from reaching their goal. The cost of land, labor market dynamics, government regulation, population flows, high home prices, and soaring rents are just a few of the culprits. Rents in San Francisco are near the all-time highs. San Francisco, San Jose, and Oakland all rank within the top 10 most expensive U.S. cities for renters.

Better education and support for home-buying is needed. A recent survey of U.S. adults by Fannie Mae makes this clear:

- Most people overestimate the financial inputs required to qualify for a mortgage.

- Thirty percent believe a 20% down payment is required (the national average is 7%).

- Only 23% are aware programs exist for low down payments.

- One in four believe ‘perfect credit’ is necessary to buy a home.

The Fannie Mae study concluded ‘current sources of mortgage education and information are insufficient’ and ‘may be holding people back.’

This is to be expected: buying a home is tough. There are many things to consider. While financing can be a beast of a process, searching involves making determinations on budget, location, property type, style, state of repair, size, amenities, and so on. Most buyers end up compromising on one or more axes. Next comes making offers, negotiating, and the closing process. Nearly half of buyers are purchasing a home for the first time, and the average U.S. homeowner stays put for a decade. Not quite like riding a bike, then.

Teaming up with friends, family, or a loved one can make buying and owning a home more affordable and more enjoyable. It also introduces added dimensions: aligning preferences, combining financial inputs, structuring co-ownership, defining rights and responsibilities, and thinking about “what if” scenarios. That’s why we founded CoBuy: to make it easier to buy and own a home together, intelligently. Every month, we bring you objective analysis to help make sense of what’s going on in the local housing market. Better information = better decision-making.

Happy summer!

-Team CoBuy

At a glance

Market conditions continue to play out in-line with our expectations. The inventory of homes for sale has increased as is to be expected this time of year, though strong buyer demand continues to push home prices upward.

San Francisco-Oakland-Hayward Metro Area

| Median List Price | $954,500 (+14% year to date) |

| Active Listings | 6,461 properties (+15% vs. last month) |

| Single-family Home Sales | +19.4% (vs. last month) |

| Days on Market | 28 days (flat vs. last month) |

Source: data from realtor.com, sales data for “SF Bay Area” from CAR.

Interpreting market conditions can be challenging. Are housing markets around the Bay cooling off or heating up? The devil is in the detail. We see prices rising, strong demand, and increased competition, all at a healthier, more sustainable clip than in the first half of 2018.

Activity levels, the depth of buyer demand, and competition vary by geography and price point. On average, buyers can expect properties listed near or below the median sale price for a given locale to receive multiple offers and greater competition.

In May, the median sale price for a single-family home in San Francisco and Alameda Counties clocked in at $1.7 million and $959,000, respectively. For desirable, well-priced properties listed up to these bright lines, buyers can expect to face competing offers. To increase competitive positioning, buyers may choose to team up with friends or family members to increase their purchasing power. Whether financial participation comes in the form of a gift, a loan, or co-ownership, adequate preparation is essential. Co-buyers should agree upon and define shared objectives up front. Naturally, support from a team of experienced professionals provides distinct advantage before, during, and after the purchase.

Drivers

We reorganize the main themes we see driving local housing markets over the near term, though our conviction remains unchanged.

- The cost of borrowing

- Supply & demand

- Local and national economies

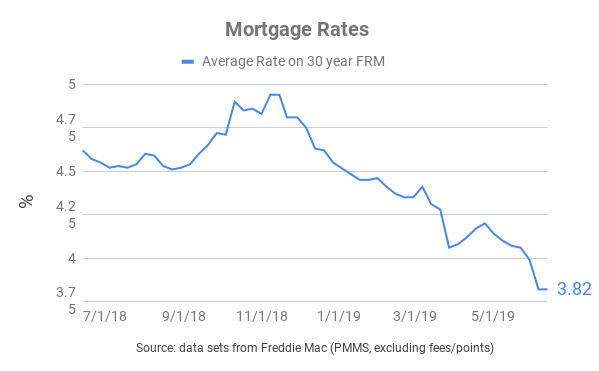

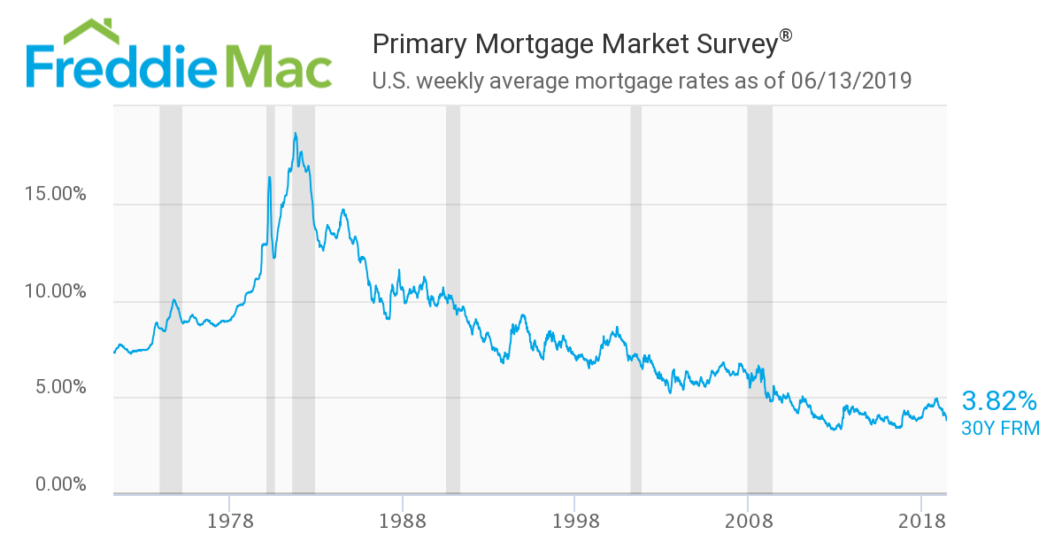

Access to financing is a prerequisite to purchasing a home for most homebuyers. As the cost of borrowing has fallen, so has the cost of buying a home. Many prospective buyers who have been on the fence regarding the timing of their purchase have been incentivized to pull the trigger by lower mortgage rates. At the time of writing, the average rate for a 30-year fixed-rate mortgage hovers at 3.82% (ex-fees/points). The cost of borrowing to finance a home is currently near historic lows. We explore this theme in more detail below.

The supply and demand dynamics of housing in the Bay area will have implications for the market for years to come. Put simply, there is a severe and growing shortage of housing in the Bay. Job growth and population growth have far exceeded the production of new housing units over the past decade (see our May update). In 2017, new jobs created around the Bay outnumbered new housing units produced by 3.5 to 1. Public and private initiatives seeking to remedy this fundamental imbalance are generating fierce opposition on based on scope and methodology. An overhaul of residential zoning and planning processes is badly needed, but unlikely to materialize overnight. Furthermore, these changes will require participation at multiple levels of government and community.

Robust local and national economies have created a sizeable professional class of residents with significant purchasing power and demand for housing. Of the top ten cities with the highest median income nationally, five are in the Bay. San Francisco ranks first globally for billionaires per capita: 1 in 11,600 residents can claim membership in the three comma club. While the impact of numerous IPOs this year on the housing market hasn’t been as drastic as some called for, this could change as traditional six-month restrictions on the selling of shares by employees expire.

Price action

On the up…

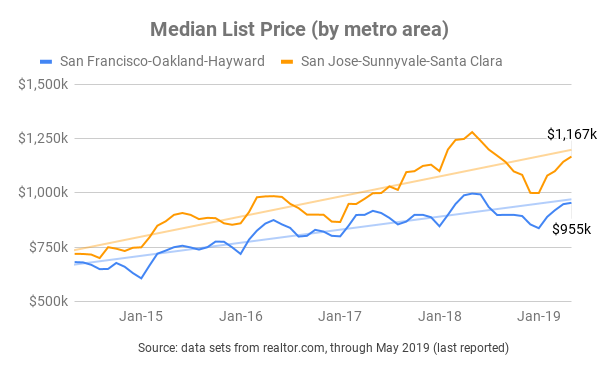

In aggregate, home prices have approached the peaks reached in 2018 across the Bay. The first graph below shows the evolution in the median list price by metro (note the distinctions between list price, sale price, and home values below).

It is worth highlighting that the price appreciation seen in the first half of last year was particularly aggressive, and empirically neither sustainable nor desirable. Today, price appreciation is moderate, and market demand is digesting fresh supply at a healthy pace. Typically, May sees peak activity in the Bay area housing markets. We expect the market will continue to experience strong demand over the coming months with moderate price appreciation, barring any shocks.

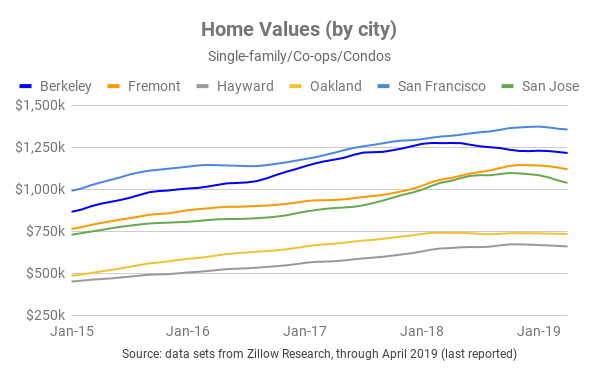

Home value indices have yet to reach the peaks registered in 2018. As the latest data available is from April of this year, the rolling average should adjust upward if the current trend up price appreciation continues or prices remain flat.

Median Sale Price (by county): Single Family Homes

Source: data from CAR

Median Sale Price (by county): Condos & Townhomes

Source: data from CAR

Jargon Busting

List Price: the price at which a seller advertises a property for sale on the market.

Sale Price: the price at which a seller and a buyer agree to transact. The median sale price for a given data set is the price “in the middle” of all sale prices when arranged in order of value. Referencing the median sale price instead of the mean sale price is useful as it reduces skew from outlying data points.

Home Value: a proxy for the value of a property, or how much it is “worth”. Ultimately, the true determination of value can only be established through transacting. Most homes in a particular geography aren’t on the market, so indices are constructed in order to monitor fluctuations in local home values in aggregate.

Supply & Demand

Too few homes.

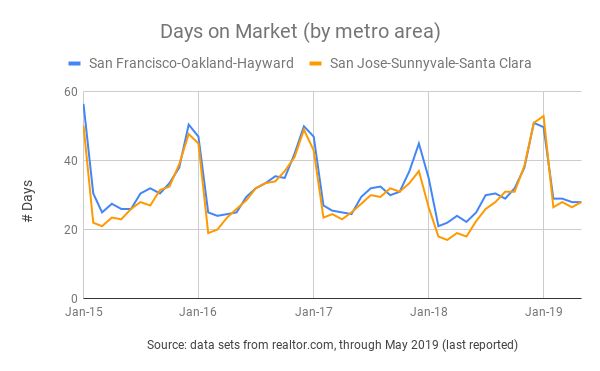

Strong demand has fueled an increase in the number of home sales across the Bay. In May, single-family home sales increased by 8.3% in San Francisco County and 15.1% in Alameda County, month on month. In both the San Francisco and San Jose metro areas, the median days a home is on the market hovers at 28 days. Well-priced properties in cities and neighborhoods with greater competition can sell in two weeks or less.

Seasonality is definitely a factor behind the bump in sales and increased competition, as is the fall in rates. Some market participants believe a contingent of sellers is deferring listing their homes in anticipation of higher prices - perhaps from the injection of capital to the local economy resulting from IPOs. Due to constrained supply, some homeowners who might otherwise choose to sell their home could be deciding to stay put. Selling their existing home would necessitate buying another home. For local residents intending to remain in the Bay, this could be a deterrent.

Rates

If you lend it, they will come.

The cost of borrowing to finance a home purchase is substantially lower today than at the start of 2019. The average rate for a 30-year fixed-rate mortgage has fallen by nearly 70 basis points year to date.

To put this into perspective, consider an example.

Example:

A CoBuy group purchases a home in the San Francisco-Oakland-Hayward metro area.

Assume:

- Purchase price = $955,000 (equal to the current median list price)

- Down payment = 20%

- Mortgage loan-to-value = 80%

- 30y fixed-rate mortgage

Scenario 1: CoBuy group borrows @ 4.600%

Monthly Payment: $3,917

Total Payments: $1,410,120

Scenario 2: CoBuy group borrows @ 3.900% (70 basis points cheaper)

Monthly Payment: $3,604

Total Payments: $1,297,440

Note: Monthly Payment includes loan principal and loan interest. Total Payments is the sum of all monthly repayments over the full 30-year term.

Result of mortgage rate dropping by 70 basis points:

Monthly Payment: $313 savings

Total Payments: $112,680 savings

Swings in the cost of borrowing have significant implications for affordability.

The cost of borrowing is near historic lows.

This has spurred demand from homebuyers, as evidenced by the increase in mortgage applications over recent weeks. The increase in activity from prospective buyers (and homeowners exploring refinancing) is challenging the bandwidth of many mortgage lenders during an already busy buying season.

Pro tip: Buyers benefit from working with a mortgage lender who is responsive, experienced, and excellent at execution. In competitive markets, these are often prerequisites to a successful purchase. CoBuy works with vetted, ethically-aligned lending institutions and loan officers who rank among the best in the business. We do not benefit financially when CoBuyers choose to work with a CoBuy-certified™ Lender, but you may.

Freddie Mac forecasts the average rate on a 30-year fixed-rate mortgage to average 4.1% in 2019 and 4.2% in 2020. Chief Economist Sam Khater predicts favorable mortgage rates will contribute to increased home sales nationally for the remainder of the year.

U.S. Economy

A solid run.

The U.S. economy is experiencing what may turn out to be the longest period of economic expansion in its history. Growth is strong, unemployment is at a 50-year low, inflation is below the 2% target, and consumers are optimistic on the whole.

| GDP | Unemployment | Inflation | Consumer Confidence |

|---|---|---|---|

| 3.1% | 3.6% | 1.8% | 100 |

| Strong growth reported for Q1 2019. | Virtual 'full employment'. | Below the 2% target. | 'Favorable levels' despite geopolitical challenges. |

| Source: U.S. BEA | Source: BLS | Source: BLS | Source: U. of Michigan |

It is clear that despite this impressive stretch of growth at the national level, the U.S. faces growing economic disparity at the individual level. Still, many of those who live and work around the country have benefitted from higher incomes, appreciating assets, and financial returns. This is particularly true in economic powerhouses such as the San Francisco, San Jose, Seattle, and Austin metro areas.

According to the World Bank, U.S. growth will temper to 2.6% in 2019 and hover around 2.7% in 2020. This falls within the generally accepted range of sustainable growth at 2-3%. There is no shortage of risk factors, most immediate of which are the ongoing trade dispute between the U.S. and China, a global slowdown, and domestic labor shortages. Excitable pundits are skilled at pointing out the inevitability of future economic downturns, but not so skilled at getting the timing right. Yet the U.S. economy is relatively well-positioned in the context of current indicators.

A robust national economy fuels demand for housing, particularly in densely populated metro areas that serve as professional services and tech hubs.

Bay Area Economy

If the Bay Area were a country, it would have the world’s 19th largest economy by GDP.

Its residents are among the nations most educated and are responsible for nearly one in five patents issued nationally in the U.S. The Bay is home to 33 of the companies in the Fortune 500, second only to New York and Chicago. It beats the combined average of its peer group (NYC, L.A., Austin, Dallas, Boston, Seattle, and San Diego) across growth in wages, GDP, household income, employment, productivity, and income per capita.

| GDP | Unemployment | Wage & Salary Growth | Job Growth |

|---|---|---|---|

| 4.3% | 2.1% | 3.3% | 2.7% |

| Compounded annual growth rate of real GDP from 2014-2017. | Companies are challenged to find folks to hire, according to California Dept. of Transport. | Real per capital income is expected to surpass $135k by 2023. | Yep |

| Source: Bay Area Council 2019 | Source: BLS, DoT | Source: BLS, DoT | Source:BLS |

To say the local economy is robust is an understatement.

The most significant risk factor to its overall economic performance is a shortage of people to hire. The high cost of living is causing more Bay area residents to contemplate moving elsewhere. Amongst comparable metro areas, the Bay ranks last for the ratio of housing units created to population growth between 2003-2017.

One in five Bay area residents now works in tech. With many tech companies huddled in San Francisco and San Jose, housing in and around these jurisdictions is unlikely to see a sustained fall in demand any time soon.

Co-buying gets you more bang for your buck

Pooling resources to buy a home can be a great way to get a down payment together and to benefit from economies of scale. Every month, we illustrate the benefits of combined purchasing power with up-to-date market data.

In the example below, we assume:

- 10% down payment (not a hard requirement, many borrowers qualify with less)

- closing costs (buy-side) amount to 2.5% of the purchase price

- median list price for a 1-bed = $604k

- median list price for a 2-bed = $700k

- median list price for a 3-bed = $876k

- median list price for a 4-bed = $1,200k

Source: realtor.com data for SF-Oakland-Hayward Metro as of April 2019

Economies of Scale

| Flying solo | Teaming up to co-buy |

|---|---|

| single buyer / 1 bedroom home | 3 co-buyers / 3 bedroom home |

| A single buyer would need $76k in cash up front for down payment and closing costs. | Three co-buyers would need to each contribute $37k up front for down payment and closing costs. |

Breaking it down…

On a per-bedroom basis, purchasing a three-bedroom home in the SF-Oakland-Hayward metro is currently 52% cheaper than purchasing a one-bedroom home. Economies of scale are real! Co-buying can deliver more bang for your buck and provide greater optionality.

Related Posts

Curious about co-buying?

We're here to help, seven days a week.