Bay Area Housing Market Flash - August 2019

It seems like there’s more static than ever to sort through when it comes to local housing market news. In past updates, we outlined three drivers:

- The cost of borrowing

- Supply & demand

- The economy

These themes will continue to drive local housing markets over the coming months.

The Fed’s decision to cut interest rates at the end of July can only stoke homebuyer demand. Cheaper credit makes buying a home less expensive for buyers. Supply wise, a severe shortage of housing units persists locally, at the state level, and nationally. Around the Bay, employment is booming and wages continue rising. According to Beacon Economics, “job growth in [California] will continue…led by the tech-fueled economies of the San Francisco Bay Area.”

Local housing market performance remains tiered. San Francisco County has outperformed, with the median sale price for a single-family home increasing 8.8% year-on-year. Overall, the market remains undersupplied. We see a notable mismatch between the available supply of homes on the market and homebuyer demand. This supply-demand imbalance, along with seasonality, has resulted in fewer home purchases on a month-on-month basis.

Homes listed for sale in San Francisco and Alameda counties aren’t on the market for long: median days on market for single-family homes in both counties stands at a mere 13 days. Equally, single-family homes are selling above list price.

Finally, the demand from buyers at low to mid-price points is strong. Rents are increasing. On the whole, we expect Bay area home prices to see modest appreciation through year-end.

Buying a home together in the Bay?

Learn how CoBuy makes it easier, more efficient, and better protected.

At a glance

Month-to-month housing market data doesn’t tell a complete story and should always be evaluated in context. Big swings from one month to the next are not uncommon due to factors such as seasonality and local market dynamics.

San Francisco County

(single-family homes)

Median Sale Price

$1,762,500

(+3.8% vs. last month)

Sale Price to List Price (ratio)

+114.9%

Home Sales

-23.5%

(vs. last month)

Days on Market (median)

13 days

(-1 day vs. last month)

Source: CAR.

Alameda County

(single-family homes)

Median Sale Price

$960,000

(+0.1% vs. last month)

Sale Price to List Price (ratio)

+102.0%

Home Sales

-7.6%

(vs. last month)

Days on Market (median)

13 days

(+1 day vs. last month)

Source: CAR.

Headlines

- Interest rates: The Fed cut the federal funds rate by a quarter percentage point on July 31st, citing weaker global growth and trade policy uncertainty. In a statement, Fed Chairman Powell noted: “the outlook for the U.S. economy remains favorable and this action is designed to support that outlook.”

- U.S.-China trade tensions look set to continue, with the U.S. Treasury moving to designate China as a currency manipulator.

- The costs of staying in the middle class are going up. Over three decades, U.S. household income has increased by 135%, while the cost of housing has risen by nearly 200%.

- Housing remains chronically undersupplied, particularly in the starter-home segment. As construction, material, and labor costs continue to rise, building new starter homes becomes less economically viable for builders. Meanwhile, American homeowners are increasingly deciding to age in place.

- Locally, the supply problem is intensifying. California state officials estimate 180,000 new homes must be built annually to meet demand in the state. Over the last twelve months, only 93,000 new permits have been issued.

- Investors are buying more of the available housing stock. Last year, investors accounted for 11% of all home purchases nationally.

Rents

Across the Bay area, rents continue to increase. What’s driving this move? Job growth, wage growth, an outperforming local economy, and a shortage of housing units.

Source: ZRI data from Zillow Research. *All homes incl. MFH.

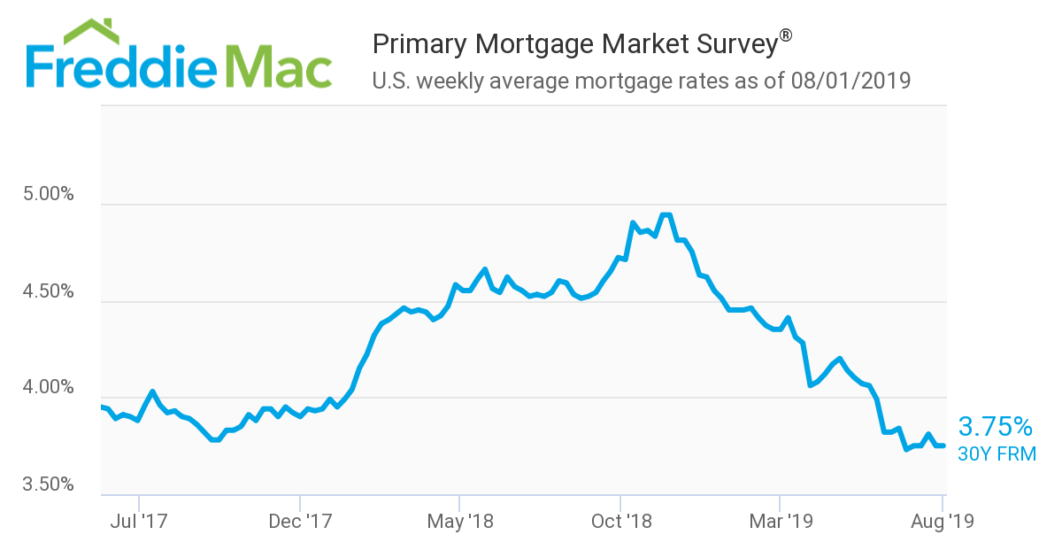

Mortgage Rates

The rate cut by the Federal Reserve was widely expected by the market, which had priced the move in ahead of the announcement. Still, the average rate on a 30-year fixed-rate mortgage has fallen 75 basis points since the start of 2019. As mortgage rates fall, so does the cost of buying a home. Cheaper credit is likely to fuel demand from homebuyers through year-end.

According to Freddie Mac Chief Economist Sam Khater, “the combination of low mortgage rates, tight labor market and high consumer confidence should set up the housing market for continued improvement in home sales heading into the late summer and early fall.”

Pro tip: Buyers benefit from working with a mortgage lender who is responsive, experienced, and excellent at execution. In competitive markets, these are often prerequisites to a successful purchase. CoBuy works with vetted, ethically-aligned lending institutions and loan officers who rank among the best in the business. We do not benefit financially when CoBuyers choose to work with a CoBuy-certified™ Lender, but you may.

Co-buying gets you more bang for your buck

Pooling resources to buy a home can be a great way to get a down payment together and to benefit from economies of scale. Every month, we illustrate the benefits of combined purchasing power with up-to-date market data.

In the example below, we assume:

- 10% down payment (not a hard requirement, many borrowers qualify with less)

- closing costs (buy-side) amount to 2.5% of the purchase price

- median list price for a 1-bed = $604k

- median list price for a 2-bed = $700k

- median list price for a 3-bed = $876k

- median list price for a 4-bed = $1,200k

Source: realtor.com data for SF-Oakland-Hayward Metro as of April 2019

Economies of Scale

| Flying solo | Teaming up to co-buy |

|---|---|

| single buyer / 1 bedroom home | 3 co-buyers / 3 bedroom home |

| A single buyer would need $76k in cash up front for down payment and closing costs. | Three co-buyers would need to each contribute $37k up front for down payment and closing costs. |

Breaking it down…

On a per-bedroom basis, purchasing a three-bedroom home in the SF-Oakland-Hayward metro is currently 52% cheaper than purchasing a one-bedroom home. Economies of scale are real! Co-buying can deliver more bang for your buck and provide greater optionality.

Learn how CoBuy makes it easier to buy a home together, intelligently.

Get in touch.

CoBuy makes it easy to buy & own a home together, intelligently. We work with buyers to navigate the purchase process efficiently and effectively. Best of all, we don’t charge buyers to use our service.

Considering buying a home with friends, family, or a loved one? We’d love to hear from you. Create an account at CoBuy or drop us a note below for more info.

Related Posts

Curious about co-buying?

We're here to help, seven days a week.