Co-buying a home with a little help from the Bank of Mom & Dad

It’s tough out there for young adults who want to buy a home.

Benchmarked against their parents at the same age, the average millennial has a lower income, less savings, and more debt. They face home prices 35% higher than those faced by their parents (income-adjusted) and can likely expect further increases due to a chronic shortage of housing at the national level. This is not positive news for today’s aspiring homeowners. Despite these challenges, most Americans prefer to own a home. A report published last year by Bank of America revealed that 3 in 4 U.S. millennials view homeownership as a top life priority. Only 50% said the same about getting married.

Friends and family support is common.

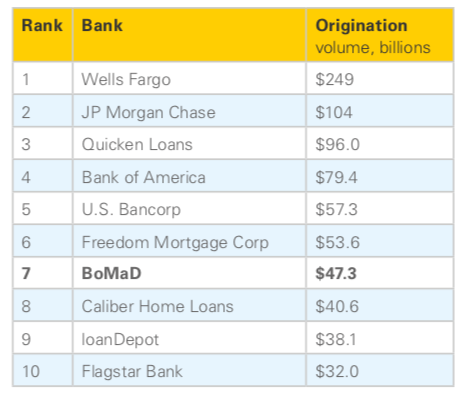

Many first-time buyers are turning to friends and family for financial assistance to purchase homes. Earlier this year, a study commissioned by Legal & General examined the scale and scope of this assistance. The study found that one in five current U.S. homeowners received financial help from friends or family (a.k.a. The Bank of Mom and Dad) when they purchased their home. It turns out the Bank of Mom and Dad has considerable financial firepower. It contributes $47 billion annually to help fund the purchase of 1.2 million homes. That’s an average contribution of $39k. If BoMaD were an actual lending institution, it would rank as the nation’s seventh-largest mortgage lender.

U.S. Mortgage Lenders by $ Volume in 2018

Source: Bank of Mom and Dad, Legal & General 2019.

But BoMaD isn’t an actual lending institution nor does it operate like one. Unlike a home loan underwritten by a licensed lender or bank, financial support from BoMaD can take the form of a gift, a loan, or equity in the home. Gifts or loans are often used towards funding the down payment and closing costs for the purchase. In practice, this type of funding is often informally arranged between the parties involved and sometimes executed without clearly agreed, defined terms.

Start by sorting out the details.

It is in the best interest of those contributing funds and those receiving funds to have an open, honest dialogue about the terms of financial support, each party’s goals, and each party’s expectations. In fact, transparent discussions should be the first step. Talking through the details of the arrangement is essential as it will highlight any discrepancies in thinking, flag issues that require further research or professional support, and provide peace of mind for everyone involved.

- Participation. Who will be contributing funds? Who will be receiving the funds and purchasing the home? Who will occupy the property? Who will be a non-occupant investor? Will partners, significant others, or friends be involved in any capacity? How might participation change in the event of marriage, divorce, or separation?

- Dollar amount. How much is required? What is each party comfortable with?

- Source of funds. Will friends and family draw the funds from savings, home equity, retirement, the sale of an asset, or another source?

- Structure. Will the funds take the form of a gift? A loan? Will the contributing friends or family members be involved as co-borrowers or co-signers on the mortgage? Who will be listed on Title?

- Timing. When will the funds be made available? In the case of a loan, when is repayment expected and on what terms? In the case of co-ownership, what is the projected timeline for an exit, sale, or buy out? What factors or circumstances, if any, could cause these timelines to shift?

- Conditions. Are their conditions, caveats, or developments that may affect any aspect of financial participation?

Treat the arrangement like a business partnership.

No matter the connection between participants, it’s best to approach the arrangement like a business partnership. By default, the parties involved are likely to have strong personal bonds and trust one another. Making the terms of the arrangement explicit by writing them down is a great way to minimize the potential for misunderstanding, reduce the likelihood of conflicts, and to protect the integrity of the relationship(s). Whether the financial support takes the form of a gift, a loan, or equity, documentation will be required by the mortgage lender and the IRS. Depending on the format of the financial contribution, there will be unique considerations, requirements, and implications for financing, taxes, and accounting. For example:

- Gifts above $15,000 may incur a federal gift tax of up to 40%.

- Loans must be properly documented and disclosed to the mortgage lender when applying for financing. In order to avoid incurring gift tax, the interest rate on the loan will need to comply with IRS guidelines.

- Loans disguised as gifts can cause problems with the IRS, violate the contractually agreed terms of the mortgage, and expose those involved to financial penalties.

- Co-ownership arrangements, where friends or family receive an ownership interest in the the property in exchange for their financial contribution, necessitate the drafting a co-ownership agreement. This agreement specifies things like participation, roles, rights, and responsibilities for each party to the arrangement.

Don’t ‘wing it’, it’s not worth the risk.

In life, love, and real estate, disagreements between loved ones can and do occur. In one recent episode that made headlines across North America, a married couple and their grown daughter fell out ever-so-publicly following a lengthy legal dispute over property rights.

The parents had advanced their daughter $110k to purchase a home as a primary residence. The daughter happily accepted the support and regarded the lump sum as a generous gift. Unfortunately, the parents did not see it so. When the parents received a chunky tax bill from the government, they decided to sell the home to cover the costs of the tax. This, of course, caused the daughter a certain degree of distress. She responded by suing her parents to block the sale of the home in which she was living (and considered to be her own). Her attempt was eventually overruled by a judge on the basis there was insufficient documentation to support her claim to ownership.

In the fall out, the parents expressed their grief at the irreconcilable damage to the relationship with their daughter caused by what they intended to be a measure of good faith. One press report released after the incident read:

“The mom…hopes other parents get a legal agreement that stipulates exactly what the parties intend in such a situation.”

The bottom line.

Approached intelligently, securing financial support from friends or family can be a great way to get on the property ladder and start building equity as a homeowner. Those who do choose this route are wise to plan and document the arrangement carefully. Ultimately, it’s a good idea to consult licensed lending, legal, and tax professionals who have relevant domain expertise. With money, relationships, and a home at stake, there’s no sense in spending a dollar to save a dime.

CoBuyer Genya S.

Learn how CoBuy helped Genya and her partner navigate the process of co-buying a home with support from family members.

Get in touch.

CoBuy makes it easy to buy & own a home together, intelligently. We work with buyers to navigate the purchase process efficiently and effectively. Best of all, we don’t charge buyers to use our service.

Considering buying a home with friends, family, or a loved one? We’d love to hear from you. Create an account at [CoBuy](http://www.gocobuy.com) or drop us a note below for more info.

Related Posts

Curious about co-buying?

We're here to help, seven days a week.