CoBuy Greater Seattle Housing Market Update – Nov 2018

We surveyed top real estate pros from our network of agents, loan officers, and builders in and around Seattle to get the skinny on what’s going down in the Seattle housing market. Data is a funny thing – often sliced, diced, and compiled to suit a purpose. Our goal is simple: ask people who are well-positioned in the market what they’re seeing. We asked 10 multiple choice questions + 1 open-ended question, and we’ll do the same next month.

So long, bidding wars.

The Seattle market is cooling off – albeit from a starting point of “red hot”. Frenzied bidding wars and waived contingencies are no longer commonplace. We are seeing a rebalancing of the dynamic between sellers and buyers, and Seattle homes are now selling within 1% of list price. Seattle single-family home prices have increased 68% over the past 5 years, and many pundits think this cooling off is a positive development.

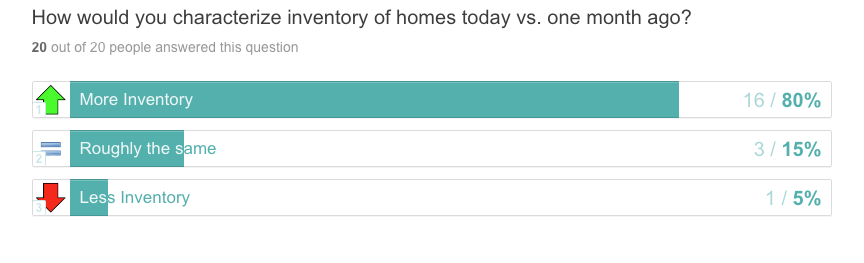

The good news for buyers is that there are more homes on the market. Inventory is up 80% in King County versus one year ago. With the increase in inventory, some reports speculate that Amazon’s HQ2 plans could threaten the market with excess supply (Amazon’s HQ2 will employ 50,000 people). But news of Amazon’s HQ2 isn’t exactly news, and the region remains a strong draw for the tech sector. Over the last year, 67,000 high-paying tech jobs were advertised in Seattle, and 11% overall job growth is expected in Seattle tech over the next five years.

Meanwhile, many buyers are weighing up the impact that rising interest rates could have on their purchase. Financial markets expect the Fed to hike the Federal Funds rate in December, and three more times in 2019. The average 30-year fixed mortgage rate – which tends to track the 10-year US Treasury – has jumped from 3.95% to around 5.00% this year. Further rate hikes by the Fed would increase the cost of borrowing and render buying a home more expensive.

For example, let’s assume you’re looking to purchase a home for $750,000 with 10% down. A rate increase on a 30-year fixed mortgage from 5% to 5.5% would add $75k in interest payments over the term, and increase monthly mortgage payments by over $200. In discussions with our survey respondents, it seems some buyers are factoring rate expectations into their decision-making.Understanding current market trends and market dynamics is crucial to getting it right when it comes to negotiating terms on your new property. If you are considering co-buying a home with friends, family, or your partner, a great first step is to log on to CoBuy or get in touch.

Key Takeaways – Greater Seattle Housing Market

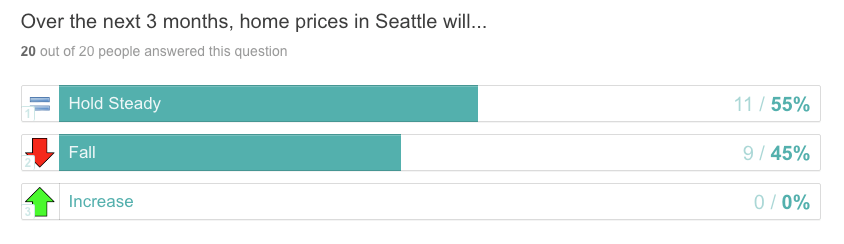

More than half of respondents expect home prices to hold steady over next 3 months

70% of respondents see less competition amongst buyers vs. last month

Four in five respondents said inventory has increased

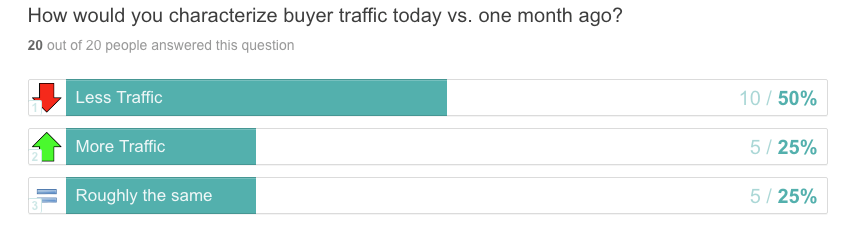

Respondents are split on buyer traffic versus last month

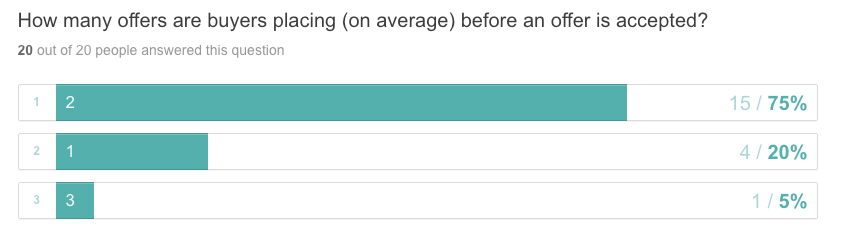

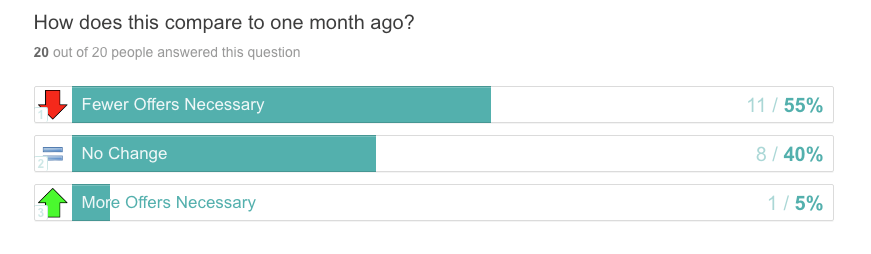

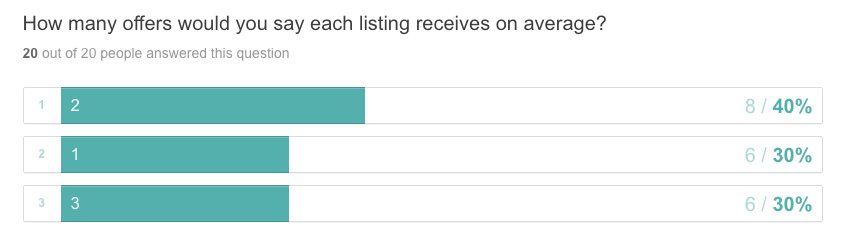

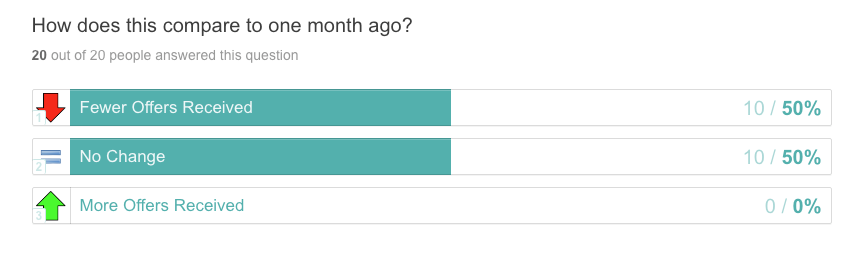

Respondents say buyers are placing 1-2 offers on average before reaching mutual acceptance, while listings are receiving 1-3 offers on average

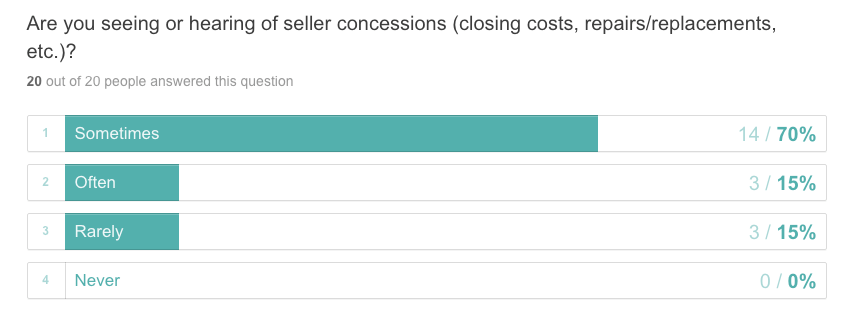

Seller concessions are being seen in some cases

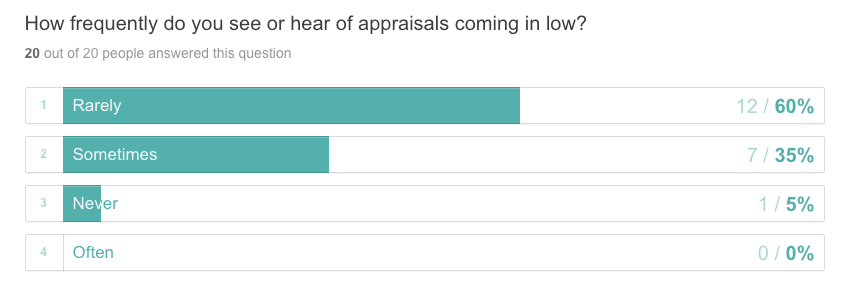

Most respondents said it’s rare to see appraisals coming in low

Here’s what some of our respondents had to say about the Seattle housing market:

“The market has slowed. This is a great time for buyers!”

“I’m really happy to see this market correction. It levels the playing field a bit and makes it easier for buyers to buy without having to waive contingencies.”

“The market has shifted toward buyers, however there seems to be more competition for homes priced under $450K.”

“Feels like buyers have come back into the market after taking August and September off.”

“There is a definite softening of the market but for buyers this is a good thing making buying a home more of a possibility now!”

“I think a lot of buyers got frustrated when the market was hot (multiple offers etc) and then signed 1- year leases.”

Survey Responses

Here are the raw survey results from our network of real estate professionals:

For more info on how to get in on the housing market, check out CoBuy or subscribe to our mailing list. Our online platform makes it easy to buy a home with friends, family, or a loved one. We guide you through the process from start to finish, assisting with planning, joint financing, and preparing a co-ownership agreement.

Related Posts

Curious about co-buying?

We're here to help, seven days a week.