Co-buying a home? Pick the right “deal team”.

Co-buying a home? Pick the right “deal team”.

Co-buying a home with friends, family members, or your partner can provide added flexibility when it comes to your housing decision, increase your purchasing power, and help diversify risk. With the right planning, the co-buying process can go smoothly and result in a successful co-ownership experience. But make no mistake, buying a home is a big deal. Whether the home is intended as a primary residence, a second home, or an investment property, a large sum of money is involved.

At CoBuy we have had the pleasure of connecting with thousands of past, present, and future co-buyers. Our experience has shown us that real estate is truly a team sport. We find time and again that when co-buyers have the support of vetted, experienced pros who are working together for the benefit of the client, everybody wins. We have built our business around this conviction and the results speak for themselves.

Multiple professionals are involved

The homebuying process involves multiple moving parts and requires the participation of licensed professionals. At a bare minimum, buyers will normally engage a loan officer and a real estate agent. Licensed professionals from title & escrow and insurance will also usually be involved. Sometimes buyers decide to consult a real estate attorney and/or an accountant for added peace of mind or to ensure compliance with the law and tax authorities.

Loan Officers

- Meet with loan applicants to gather personal information and answer questions

- Explain different types of loans and the terms of each type to applicants

- Obtain, verify, and analyze the applicant’s financial information, such as the credit rating and income level

- Review loan agreements to ensure that they comply with federal and state regulations

- Approve loan applications or refer them to management for a decision

Source: U.S. Bureau of Labor and Statistics

Real Estate Agents

- Advise clients on prices, mortgages, market conditions, and related information

- Compare properties to determine a competitive market price

- Generate lists of properties for sale, including details such as location and features

- Take prospective buyers or renters to see properties

- Present purchase offers to sellers for consideration

- Mediate negotiations between buyer and seller

- Ensure that all terms of purchase contracts are met

- Prepare documents, such as…purchase agreements, and deeds

Source: U.S. Bureau of Labor and Statistics

The more experienced this “deal team” and the better the communication between the professionals involved — both amongst each other and with the buyer — the higher the likelihood of a successful transaction. This is even more true when we consider a transaction involving co-buyers, since by definition co-buying introduces unique considerations both during and after the purchase.

For success, choose the best

Like in sports, the caliber of your team will have a strong bearing on the end result. The good news: you’re the manager and you get to choose who you work with. You’ll want to involve folks who have your best interest at heart and have experience dealing with joint purchases and co-ownership scenarios. You want a Dream Team on your side, not the junior varsity squad. So what should you look for in a loan officer and a real estate agent?

- Ability to listen

- Experience

- Local market expertise

- Strong testimonials

- Transparency

- Responsivity

- Availability

- Ethical alignment

- Network of contacts in related professions (legal, tax/accounting, etc.)

Sounds reasonable, right?

Consider this — only 49% of real estate agents in the U.S. are full-time. The requirements for licensing in many states involve being at least 18 years of age and passing an exam. Conventional wisdom holds that 10% of agents do 90% of the business. Clearly, there is a spectrum of talent and experience amongst real estate agents.

Now ask yourself this: if you are going to embark on what may be the most significant purchase in your life to date, who do you want on your team?

As a co-buyer of real estate, you’ll be navigating planning, consensus-building, joint financing, house hunting & transacting, structuring co-ownership, preparing a co-ownership agreement, identifying and protecting against risks. Having experienced, licensed professionals working together for you will not only simplify the process, but will benefit you both personally and financially.

Don’t take my word for it…

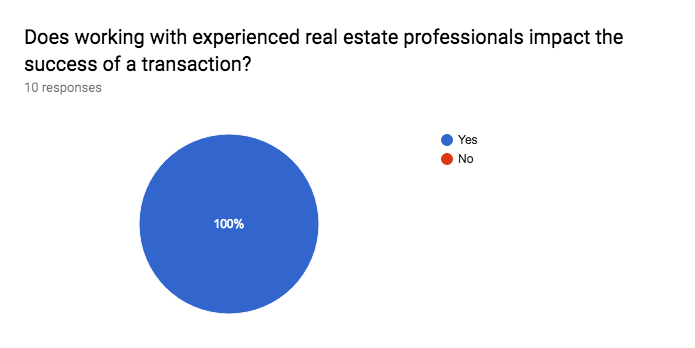

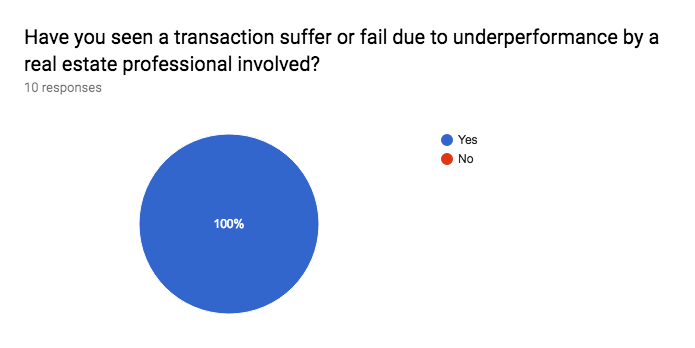

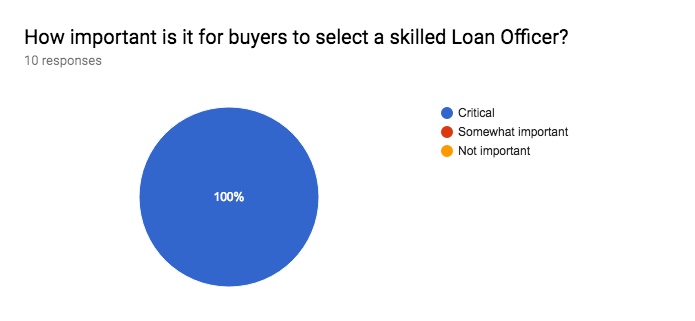

Who is better placed to comment on the mechanics of a transaction than those who are involved? We polled five veteran real estate agents and five veteran loan officers on the importance of working with best-in-class professionals. To account for inherent bias, we asked real estate agents about the importance of working with experienced, skilled loans officers and vice versa.

The results were no surprise.

“Underperformance on the part of the loan officer or the real estate agent can cause delays, missed opportunities, a lack of confidence on the part of the client and/or on the other side of the transaction. Any or all of these, can result in a failed transaction or one that never sees the opportunity to be negotiated.”

“It can slow a transaction down and create unnecessary stress.”

“An inexperienced agent may have difficulties preparing a compelling offer in a competitive environment. An inexperienced loan officer can compromise a transaction due to lack of due diligence. You don’t want to find yourself 10 days from closing only to realize the condo you reached mutual acceptance on is actually not eligible for conventional financing.”

Enter CoBuy

In 2018, if you’re looking to co-buy a home then you’re in luck. We’ve got your deal team covered.

At CoBuy, we help co-buyers navigate the homebuying process intelligently, from start to finish. We also help them establish a framework for co-ownership to protect themselves, their relationships, and their investment. We are able to offer our services to co-buyers at no added cost through employing technology, leveraging partnerships with top-notch real estate professionals, and following efficient processes. Everybody wins.

The CoBuy ecosystem includes vetted, certified professionals from lending, real estate broking, title & escrow, real estate law, tax & accounting, international tax, and insurance–your deal team. These CoBuy-certified™ Pros benefit from training and experience in co-buying and co-ownership. They have been selected on the basis of their skill, customer focus, and team orientation. Our shared ethos of putting the client first, especially when that means not doing a deal, is what sets us apart.

If you or somebody you know is considering co-buying, we want to hear from you.

We founded CoBuy to make it easier to buy a home with friends, family, or a loved one and to do it intelligently. It all started two and a half years ago at the kitchen table. We sat down to figure out the logistics of our own joint purchase. Our first discussion lasted over three hours, and we didn’t get very far despite our combined 75 years of real estate and finance experience. Numerous planning sessions followed and to say the process was overbearing is no small understatement. Following that experience, CoBuy was born out of a true desire to help people like us who had financial and social motivations for wanting to buy a home together.

For more info, check out CoBuy or subscribe to our mailing list.

Related Posts

Curious about co-buying?

We're here to help, seven days a week.